China’s success in indigenous passenger aircraft manufacturing falters due to geo-political turmoil

China has made impressive strides towards producing its own passenger jet that could make it a potential competitor to Airbus and Boeing in the next decade. Its state-owned company COMAC has been able to manufacture the single-aisle passenger plane C919, some 20 of which are already flying commercially in Chinese skies since 2023. The C919 has been bought by three Chinese aviation companies for their flights within the country. Such success, though meagre for a global aspirant, has brought credibility and appreciation to COMAC.

Making passenger planes with completely indigenous components is a formidable goal. Even giants like Boeing and Airbus procure sizeable proportion of their requirements from different companies from inside their countries and abroad. COMAC, being a beginner, is very much dependent on outside suppliers for many key components of C919. It is understood that COMAC sources its requirement of parts from as many as 48 major suppliers in the U.S., 28 in Europe, and just 14 inside the country. The American suppliers include the giants like GE, Honewell and Collins. Incidentally, India procures the engines for its Light Combat Aircrafts from GE.

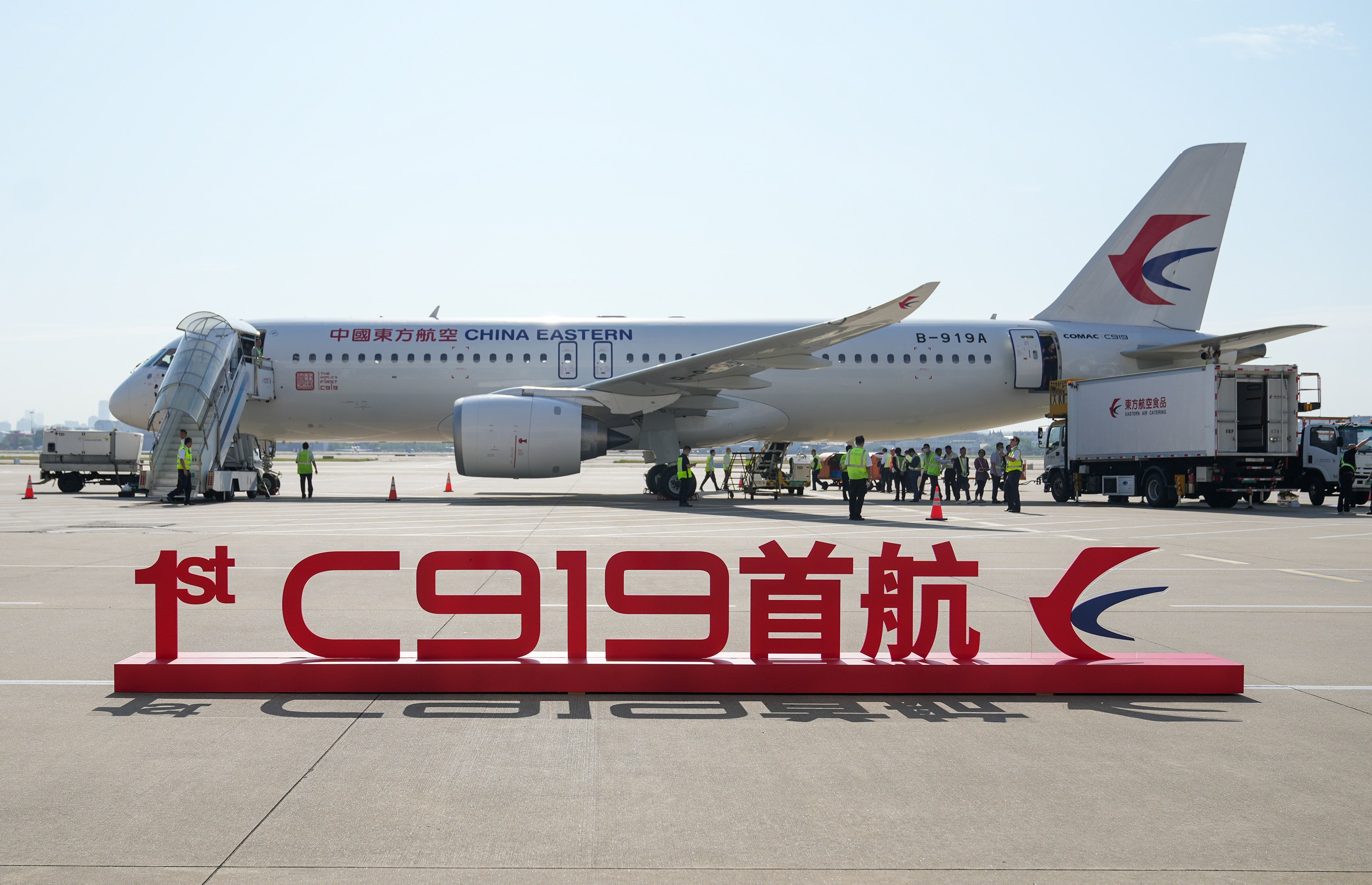

The C919 jet — a single-aisle passenger plane aiming to rival Boeing’s 737 and Airbus’ A320. (Photo sourced from The Hindu dated October 28th)

In normal times too, ensuring timely supply of components from suppliers, both indigenous and foreign, is a tricky task. Delays happen routinely due to unforeseen factors.

The advent of President Trump has completely shredded the supply chain network across the seas. China has attracted much of President Trump’s wrath due to well-known reasons. Bilateral trade between China and the U.S. now faces uncertain times. Consequently, procurement of C919’s spares from American suppliers has become tardy. The fact that COMAC gets very generous government support for its operations possibly provokes Trump. Since his coming to the White House, a lot of hot rhetoric, and imposition of punitive tariffs on each other have enfeebled the commercial ties between COMAC and its U.S. -based suppliers.

As a result of such trade turmoil, COMAC’s production targets have gone haywire. China’s ambition to make the C919 a favoured mid-sized passenger plane both inside China and in the neighbouring South East Asia is now considerably mellowed.

Domestic demand for a plane of the C919 type is quite high. So is the global demand for such mid-sized passenger planes. Despite such bright commercial hope, COMAC finds its production capacity severely curtailed, thanks to supply chain disruption. The company could deliver only 13 numbers of C919s to Chinese airlines last year. Till last October, COMAC has delivered a meagre seven airplanes against an annual target of 30. So sharp has been the fall in production, all due to external factors.

Due to such constriction in delivery, C919 aircrafts’ presence in China’s skies have been far from conspicuous. Air China, China Eastern, and China Southern are the three users of this aircraft. They fly a total of just 20 C919—a tiny number for a vast country like China. Trade friction with the U.S. lies at the root of such dismal delivery figures of COMAC.

C919 uses a high-end jet engine with model name LEAP-1C. This is co-produced by the the American company, GE Aerospace and French company Safran. The U.S. government, under Trump, lost no time to impose restrictions on export of LEAP-1C engines to China. The ban came in May, but fortunately was lifted in July. The U.S. leverages its legal hold on GE Aerospace to limit or completely stop its exports to China. For COMAC, it’s a painful disruption. The company will continue to be vulnerable to such unforeseen setbacks till China develops its own engine and avionics. That’s a far way off.

Apart from the above external factors, some internal factors have contributed to the slow-down of COMAC’s deliveries. It’s the company’s unrelenting focus on improving the security and reliability of the C919 that make the engineers examine each operation with utmost scrutiny.

China is also busy developing its own engine, named CJ-1000A, but like aero-engine development elsewhere, it is tediously slow.

There is no dearth of buyers for C919. Countries in Southeast Asia and Africa have evinced interest in buying this aircraft. Even AirAsia is toying with the idea of buying this plane. However, flying this plane in the global arena needs a permission from the American regulatory body FAA (Federal Aviation Agency). Getting the green flag from the FAA is a tenuous process.

Thus, the challenges before COMAC are three-fold. It has to cut costs, steady the ancillary supply line, and get the security thumbs-up from FAA. All three are very daunting indeed.

However, there are plenty of reasons to be upbeat. In the next 20 years, China’s indigenous demand for an aircraft like the C-919 will be around 10,000. This is a very enticing estimate that has spurred the Chinese subsidiary of Airbus to gear up. Its A320 model is a powerful rival of C919. Thus, COMAC will have to contend with the competition from the China-based arm of Airbus.

China’s COMAC dreams to break the dominance of the two western giants – Boeing of the U.S., and Airbus of Europe. This is going to be a long haul as technological and political hurdles will crop up at every step. The hurdle-ridden journey may last for decades.

—————————————END———————————–

Next post will be on India’s efforts to enter this field.